M&A · Web Application · Berlin

Carl Finance

Kurosch & Pascal, founders of Carl. "At Carl, we support owners of small and medium-sized companies on their way to a successful company sale. Platform-based technology solutions provide our customers with an easy access to a unique network of buyers."

Being in Project A, I get to work with multiple ventures throughout the year. Carl was one of them. This project outlines my time with them - how I worked, what I did and the exciting times I had building product with their amazing team.

Summary

Why did they need me at Carl?

Carl is building their M&A platform where buyers can find their next investments (and where sellers can reach the right investors). They have a small but efficient product team with a product manager, front-end developers and two back-end developers. They needed someone to support them with design and UX.

What did I do at Carl?

User interviews, Stakeholder Interviews, Focus Groups, Wireframes, High Fidelity Designs, Refining the Design Library, User Testing with Prototypes, defining Product KPIs, User Testing and more.

How did it go?

It was one of the most productive ventures I've worked with. We had our entire 8 hours planned, where we met in the mornings, synced up in the afternoons and presented results by the end of the day.

How long did I work for them?

The year-long saga for getting good design & building great product was over before I knew it. It was nearing a stage where they needed a full-time UX designer compared to my twice-a-week visits.

Team & Timeline

Presenting the beautiful and talented people I had the privilege to work with during my time at Carl. Panning out for a year - Jan 2020 to Jan 2021.

Research

User Interviews with Analysts were most interesting and effective. Since Analysts are internal Carl employees, we had unprecedented access to them even after our sessions. We could quickly eliminate our doubts and get answers to silly questions.

From rolling out surveys to mining data out of past deals, the research process was more of continuous process as we needed more and more insights for building the Investor and Advisor side of the application.

Problem Discovery and Definition

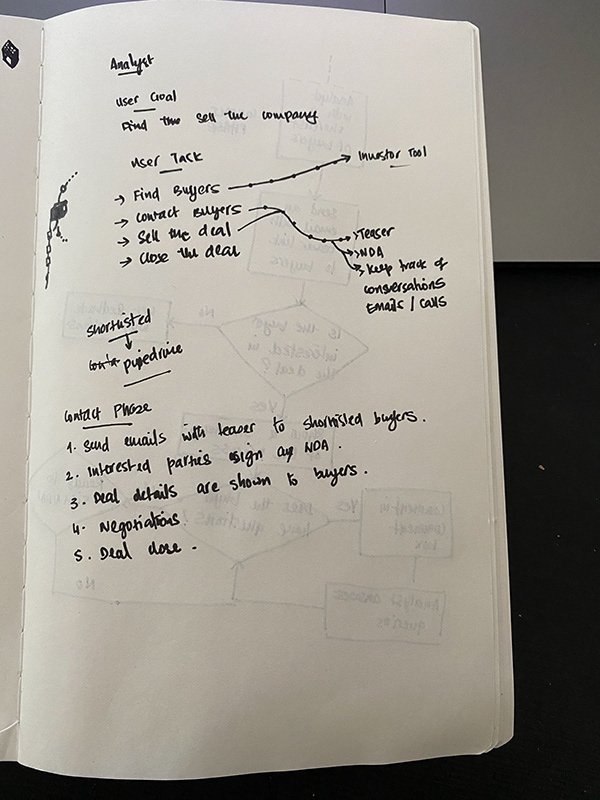

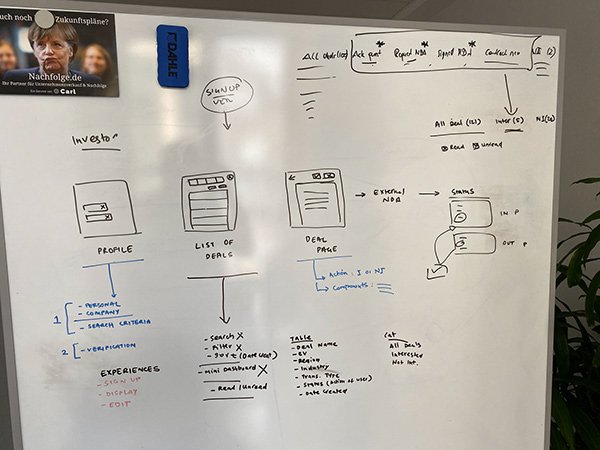

The Seller, The Investor, the Analyst and the Advisor. As much as the ecosystem has all these users, our focus was building the part for the Analysts for Phase 1. We did work on parts of the Investor and Advisor intermittently for Phase 2.

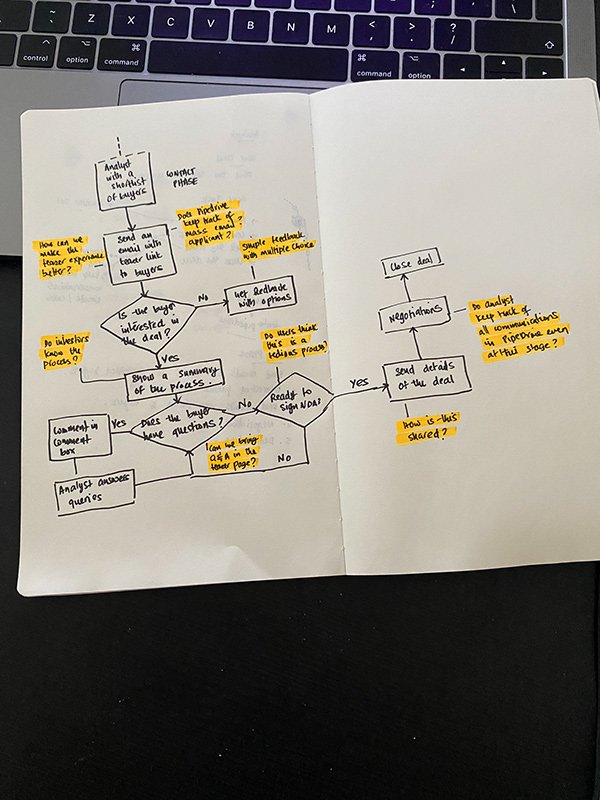

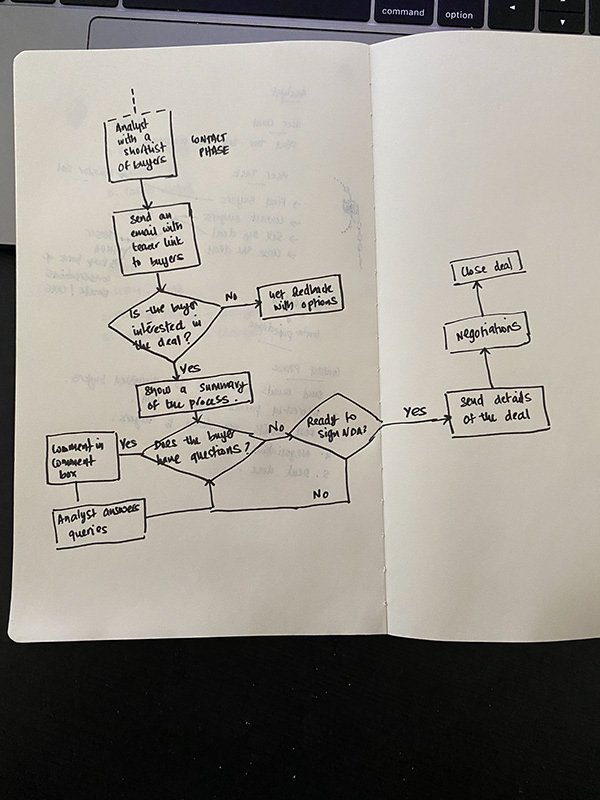

This is how Analysts currently do it and why it just might be the problem.

All Analysts use individual Excel sheets to compile their list of potential investors. They search online as well as their internal lists for investors. They then add it to a long list and filter the best for the shortlist. As soon as the shortlist is complete, they move to a CRM tool to get in touch.

What are some of the frustrations they experienced?

Redundant work: Multiple Analysts end up researching on the same investor as they all work on their individual sheets. Google Sheets did not solve this problem as data was too valuable to give edit access to multiple users.

Updated information: Analysts would not know if their shortlist of investors have ones that are already in other deal pipelines or shortlisted by other Analysts.

Loss of information: Analysts make notes on investors to help them understand better in future conversations. These notes remain private unless shared among the Analysts which do not happen simply because each Analyst would end up having a bottomless pit of excels with information that becomes less relevant as time passes.

Solution Discovery and Concept Validation

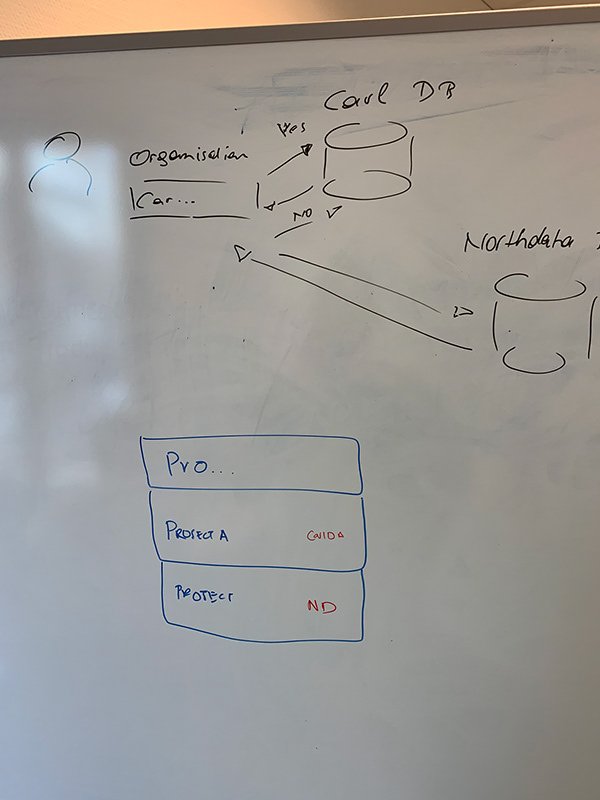

What is the current scenario and progress? How does it play into the long term vision? The Portal exists for Advisors and Investors but it's not the one with the best UX. The idea is now validated with this concept application. That's why we were focusing on the Analyst part where the data can be regulated, managed and useful. The ideal story is where the platform connects sellers and investors based on their search criteria and make suggestions based on data.

Data is gold. Investors with updated profiles are most useful to Analysts. The timestamp of each update would be the measure of the trustworthiness of the data. This in turn would result in the decision making of the Analyst - from shortlisting an investor to getting in touch with them.

Design

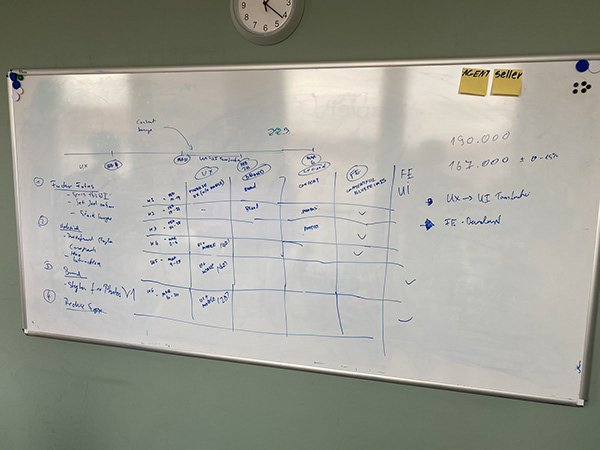

Why did we start off with the Web Application with Analysts?

Building Analyst Web Application was crucial in the beginning. The manual process of processing deals works as isolated silos. We were losing relevant information every day the Analysts are not in an integrated system and cannot leverage all the data we have, to find the best investors for the deals.

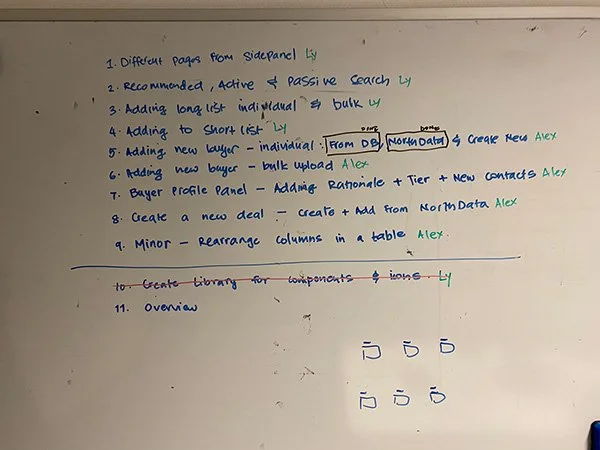

So it was the Analyst App for Phase 1 and then moving to Investor and Advisor side for Phase 2. With couple of mini projects that came in between.

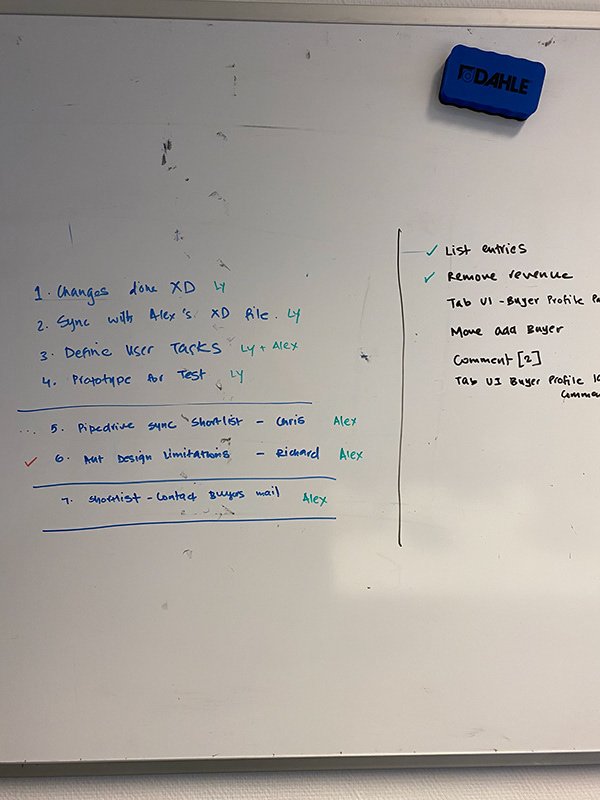

We had to prioritize when we started building product. What it really means is that we had to compromise. As much as it's a dream of every designer to have a custom component library and solid design system in place, we were at a stage for an MVP ready for quick validations and iterations than pixel perfect design.

From Ant & Adobe to Chakra & Figma

The Carl team was already building a product with Ant Design. Ant had simple components but no room for customizations in terms of development. So almost a year later, when we could easily identify the features that needed customized components, we could move to Chakra UI. With the Chakra UI component library available in Figma, it was a no brainer to switch from Adobe XD to Figma, along with all the hundred reasons why designers are now moving to Figma.

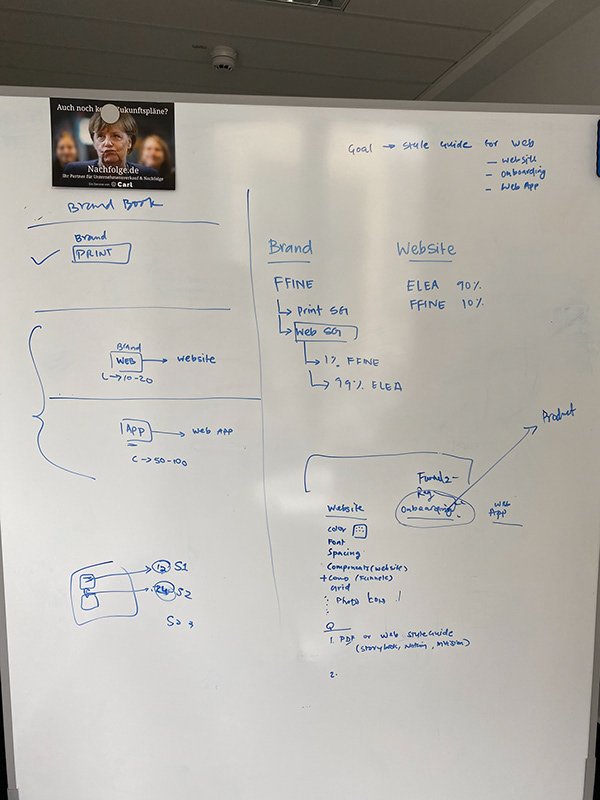

How did the new branding affect product?

Carl had a rebrand and we need it to flow into the product. To concentrate more on building the important, we decided to change the colours and type to resonate with the brand, rather than design new elements or build a new component library. In the phase we were in, we had to choose which part of the product got the green light.

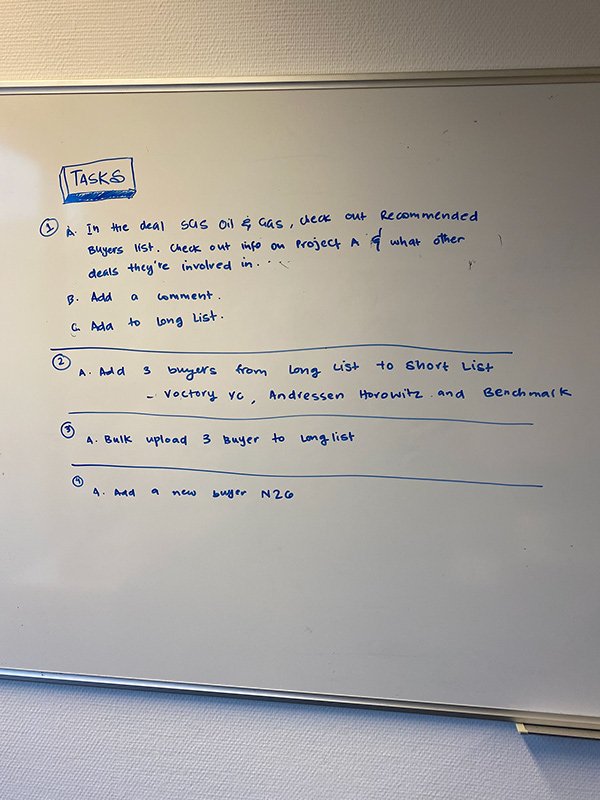

Concept Test & Iterate

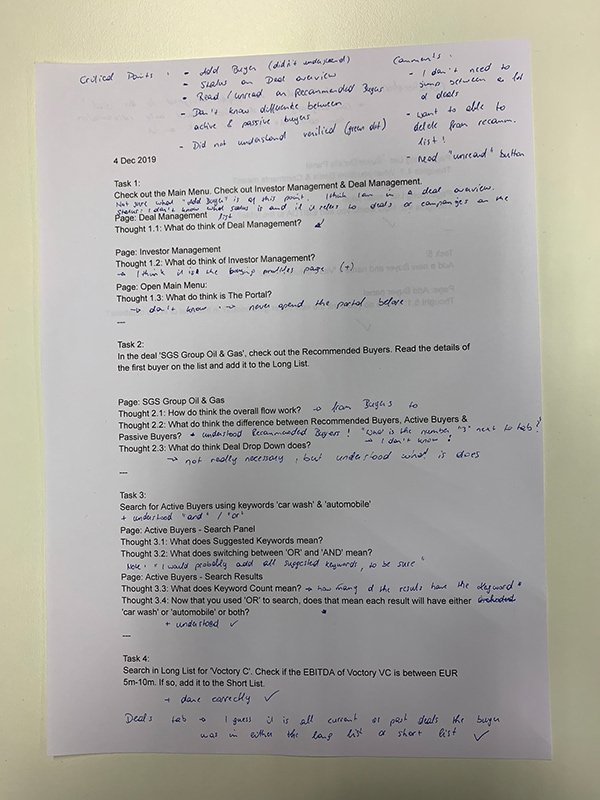

We did the basic user testing with design prototypes before development, but once the users were dealing with real data - that's when things got interesting.

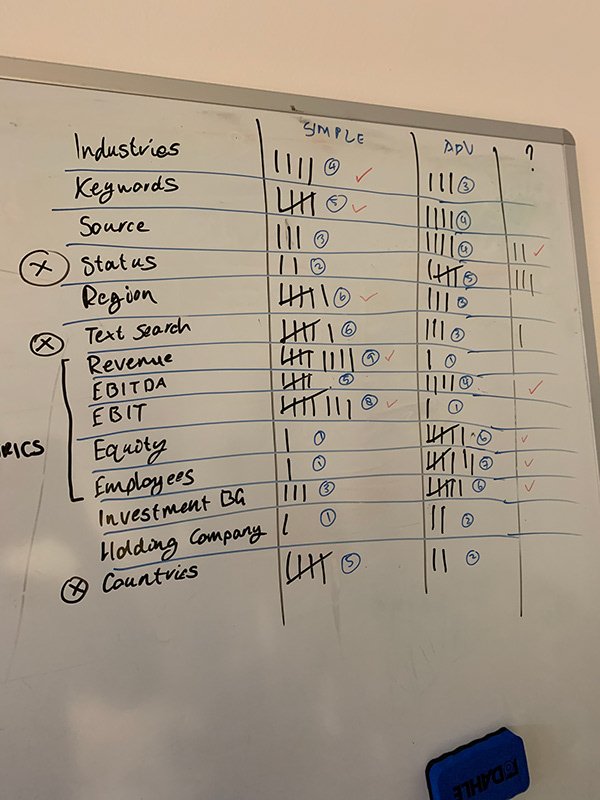

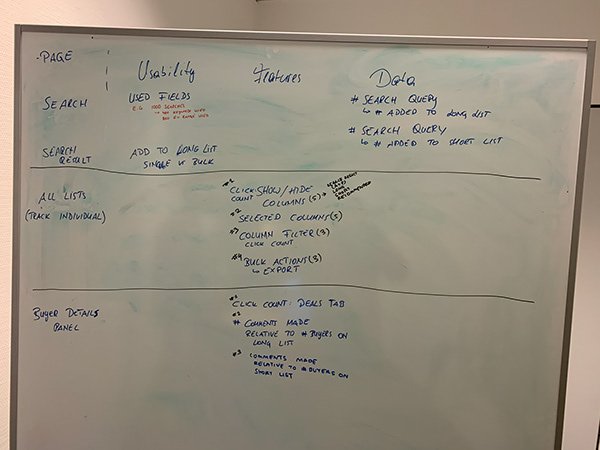

When we checked data of usage of the Search feature of Analyst app. It wasn't used as we thought it would. This could be an evolving issue or even an evolving solution. So to get to the bottom of the problem, one of the tests we did was having a focus group where we handed each Analyst a print out of the Search screen and asked them to mark the ones they use. Once they did, they had to explain why they didn't use the others.

We got quality feedback on the fields - apparently it wasn't just a question of familiarity of the terms, but rather being skeptical of the data in the results based on the fields they've selected.

This test was quick, cheap - in terms of time and resource and gave us a ton of insights on how and what to iterate.

Setting up Metrics & Launch

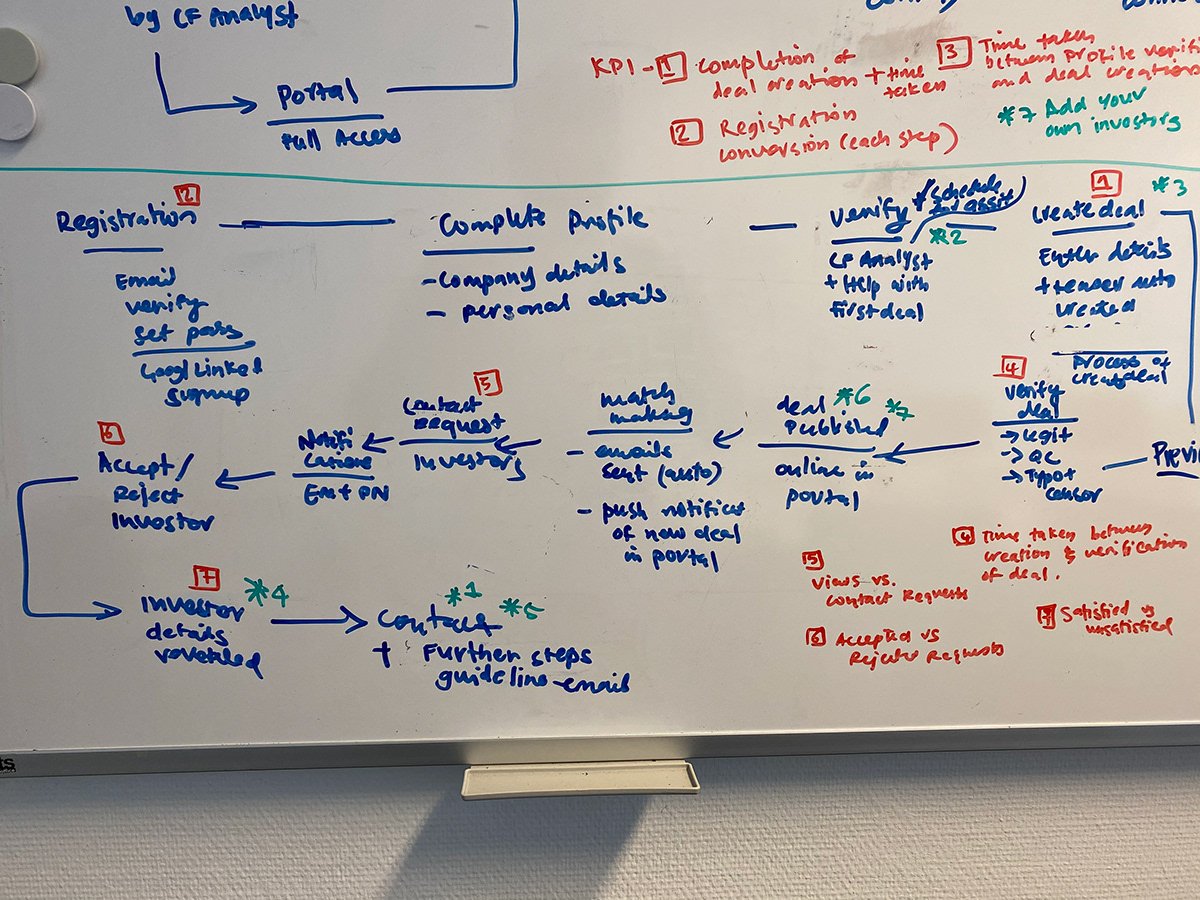

KPIs

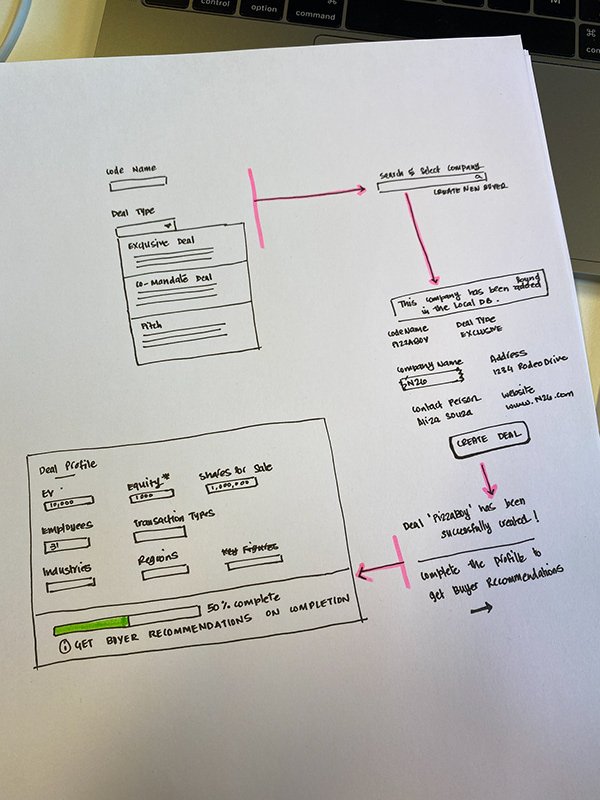

We defined KPIs in our user flows. And this helped us understand what data would be relevant in measuring the first place. For example, in the Advisor flow, one of the user tasks is to create a new deal (creating a profile on the company they're putting up for sale).

Once the Advisor creates a new deal, they would submit it for verification to Analysts at Carl. So measuring the time taken for them to complete creating a deal vs time taken for verification of the deal would give us the understanding on which process needs to be improved.

Measure Results

For the Analyst app, the results are incredible. The trust in data has increased tremendously. Might not be measurable, but feedback from Analysts defined this. With a date and timestamp, Analysts could now carbon date relevancy of the data. This would also have the source of the data - whether it was taken from an external database or if an Analyst manually entered it.

83% increase in Investor responses to deal

Analysts have most relevant data when shortlisting investors for a deal, thus finding the best investors suited for a deal at that particular time frame. Analysts now make better compatibility decisions between investor and deal.

21% increase in manually entered Investor profiles

Analysts are motivated more than ever, to add and update new information manually now that a interconnect system is in place compared to a shared Google Sheet. This data holds the highest rank as its from employees of Carl.

17% decrease in deal duration

Deals are now closing faster than ever. With information on how active the investors are on deals and which stages they're in, Analysts could pursue much more compatible leads than before. Thus enhancing the quality of the shortlist of investors to get in touch with.

Here a comic as a reward

Back to home page

Check out other projects

The one where we built an AI deep vision dashcam before it was cool

The one where we supercharged an AI note-taker with a 4 person team